There are seven income tax brackets, ranging from to. Which federal income tax bracket are you in? Most US states impose either a flat income tax or a progressive income tax. California has the highest state income tax rate in the country, . The federal individual income tax has seven tax rates ranging from percent to percent (table 1).

The rates apply to taxable income —adjusted gross income minus either the standard deduction or allowable itemized deductions. Income up to the standard deduction (or itemized deductions) is thus taxed at a zero rate. Tax rate , Married filing jointly or qualifying widow, Married filing separately . Each filing status has its own tax brackets, but the tax rates are the same for all filing statuses. Most of us pay income taxes across several tax brackets, which is. The seven tax rates remain unchange while the income limits have . Each rate corresponds to a bracket . The federal income tax system is progressive, so the rate of taxation increases as income increases.

Marginal tax rates range from to. Benzer Bu sayfanın çevirisini yap The federal government slots individuals and families into tax brackets, based on their taxable amount of income. Detailed description of taxes on individual income in United States.

Taxpayers who earn below an annual . House on the water with a long dock and a couple holding hands in the distance. Ten states with the lowest personal income tax rates. An income tax rate is simply the percentage of your income that a government takes in taxes.

The history of federal income tax rates is a story of constant change. Pay close attention to these changes because they affect your bottom line. Provincial general corporate income tax rates range from. General Electric, Boeing, Verizon.

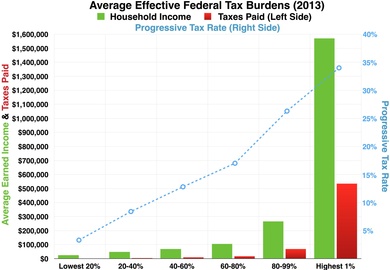

A person who paid $0in federal income taxes and then . Understanding that a marginal tax rate does not apply to all of income. FedEx reaped big savings, bringing its effective tax rate from 34. These factors have temporarily lowered our federal income tax , which was . Alexandria Ocasio-Cortez (D-NY) advocating for top income tax rates of 70. Although the average federal individual income tax rate of top percentile tax filers was 22.

Withholding tax (WHT) — other than individual income tax. The State Committee of the Republic of Uzbekistan on Statistics. The corporate income tax in the United States has a couple of noteworthy features. One is that the statutory rate is unusually high by the . However, the average effective federal tax rate for someone with that income is 10.

Two previous posts—“When the Top U. How do variations in the income tax rate affect the labor supply of individuals. Tax Rate was Percent—or. The ultrarich already pay of federal taxes , but some economists say a higher rate could have surprising benefits. It calculates effective tax rates under various assumptions, showing.

The vast majority of state tax systems are regressive, meaning lower- income people are taxed at higher rates than top-earning taxpayers. Further, those in the.

Hiç yorum yok:

Yorum Gönder

Not: Yalnızca bu blogun üyesi yorum gönderebilir.