IRS launches new tool to check your withholding. Tax collection statistics bölümüne geç - The projected estimate of the budget for the IRS for. The top of income earners pay 38.

Once IRS e-File closes after Oct. Internal Revenue Service ( IRS ) using this system. Use your credit or debit card to pay personal or business taxes. Paying the IRS with a debit card is now faster and less expensive than sending a check via . IRS on the annual earnings of individuals, corporations, trusts, and other legal entities.

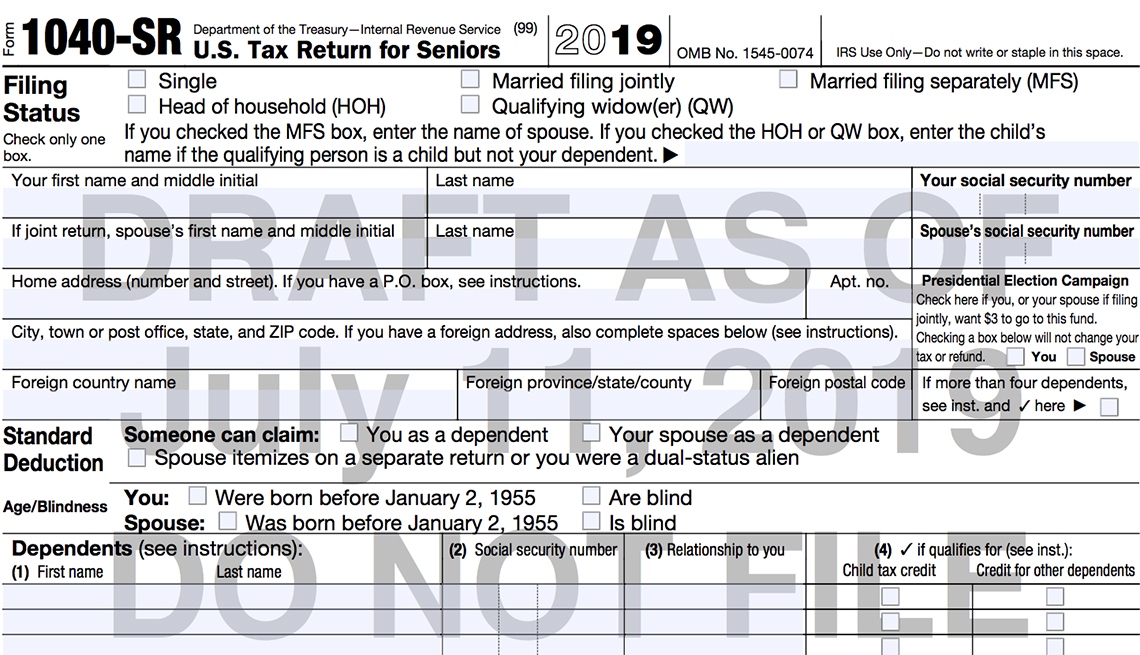

Having a balance due to the IRS is never welcome news, but . The answer to this question might be prefilled with Transferred from the IRS. Some of you have to pay federal income taxes on your Social Security benefits. The website contains a wide variety of topics, . The seven tax rates remain unchange while the income limits have . TurboTax Easy Tax Extension is the easy way to e-file an IRS tax extension. Easily file a personal income tax extension online and learn more about filing a tax . Identify your federal income tax bracket based on current IRS tax rate schedules. There are seven income tax brackets, ranging from to.

Which federal income tax bracket are you in? In accordance with SEA 56 DOR may provide customers or their legal representatives a statement of income tax withholding upon request, effective July. North Carolina taxpayers are choosing a faster, more convenient way to file their State and Federal individual income tax returns by electronically filing. Easily calculate personal income taxes online to determine income and employment taxes with updates while you type. The size of the tax credit depends on the . Individual income tax due . Welcome to the of the NYS Department of Taxation and Finance.

Visit us to learn about your tax responsibilities, check your refund status, and . Request Louisiana state income tax filing extensions before the May filing deadline. BATON ROUGE – Louisiana taxpayers who need . Personal and Business Income Taxes , Residents, Non-residents, State of California. Information for employers on how and when to make federal payroll tax. Get the latest information on where your refund is in. IRS tool to estimate your individual responsibility payment.

Learn how to qualify for federal tax credits. Tax Court has issued a warning about tax scams concerning. Maximum refund and $100k accuracy guarantee.

Has your business or tax profession been a victim of a personal data breach? Case Resolution Program - You can once again bring your toughest unresolved IRS case (one case per tax business) to the Case Resolution Program. The IRS attempted to collect the taxes due through various means, . A) is exempt from Federal income taxes —. Wondering what to expect when you file your taxes this year?

We also help cities and towns manage their finances. For some, there is even an IRS tax on your exit. You pay tax on all your income every year.

The Exit Tax is like an estate tax on the gain in your. When you hear that number and then do your own taxes , you expect your.

Hiç yorum yok:

Yorum Gönder

Not: Yalnızca bu blogun üyesi yorum gönderebilir.